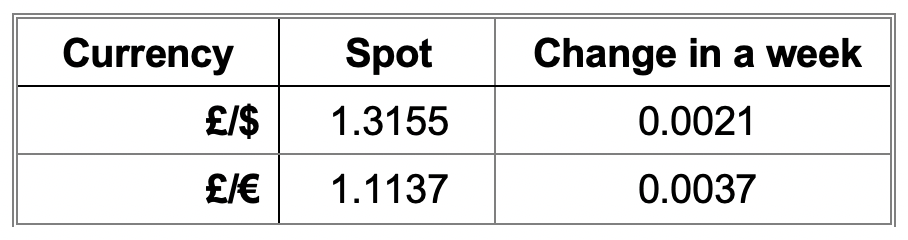

Currencies

This week has continued to see improvement in currency for Sterling. The big news from the US is the election result, although still not officially announced yet, allied to the suspicion that Trump will continue to contest the result for the full 70 days until Biden’s inauguration in January. The continued rise in Covid cases in the US has also kept a cap on the dollar. Looking closer to home, news that the Covid vaccine may well now be close and that the UK has enough to vaccinate 1/3 of the population helped fuel a jump not only in sterling but also in the FTSE market which jumped 5% in one day. Brexit negotiations are continuing in Brussels with the sentiment now that progress is finally being made. A statement this week by Goldman Sachs to ‘buy sterling and sell the euro’ would seem to support that view.

Wheat

Wheat markets appear to have slowed this week and are beginning to turn lower with the export data from the US for the last four weeks being lower than the previous four weeks. The USDA report this week only made slight adjustments to their figures, which did not really have any impact on prices.

France are 73% planted vs 68% this time last year and the feel in the UK is that farmers have managed to plant sufficient acreage this year, although we have not seen any official figures yet from AHDB on planting progress.

China have sold 82.3 million tonnes of their national reserves which totalled 56% of the available wheat on the market! The general sentiment is a cautious sense of optimism, with hope that we will see a break in prices during January.

Soya

Soya prices have had a mixed week with some profit taking towards the end of the week lowering prices slightly, although this was only triggered by contracts reaching 4 year highs. The additional demand on US beans for February to plug the gap which will be left by the late Brazilian harvest has been the main driver. USDA reported figures put the US closing stocks are at their lowest for 7 years, and dropped the overall 20/21 carryout by a further 2 Mln T.

Dryness across South America continues to be a real concern although long range weather forecasts do now show rain. It is now very much needed and without it, the market has legs to move higher still.

And Finally…

‘We’re together forever’. Moving moment when a devoted wife surprised her husband with dementia by moving into his care home.

Betty Meredith, 91, surprised her husband this week by moving into his care home after she realised that she could not live without him.

The clip which has so far been viewed thousands of times online, shows Kenneth Meredith, 96, making his way through the care home, before breaking down in tears when he sees his wife sat in front of him with the 1954 hit, ‘Only You’ playing in the background.

The care home commented saying, ‘Betty made the decision to move into Bourn View and be with her husband- but first she had to isolate in the home. Kenneth had no idea she was moving in, and the two of them were reunited with a surprise meal. In Betty’s words, they are now back ‘together forever’’.

Regards,

Kay Johnson & Martin Humphrey