Currencies

The £ hit 1.35 this week against the $ following comments that a Brexit deal is expected to be announced this weekend. It has since settled back around 1.34 and against the €, settled at 1.10. Any news of the deal is likely to be basic at this stage, with a potential extension of the transition period to minimise any economic disruption. This option has been thought the most likely outcome for some time, so in effect is largely priced into the market, therefore we may not see the sudden big swing in currency. Over in the US, Covid cases are now at their highest levels with hospital admissions following the same pattern. The US is also still struggling to pass any sort of fiscal package which will keep the dollar capped.

Wheat

The wheat market has seen a consistent movement downwards this week for the first time in months. US markets have taken their lead due to improved rain and snow coverage across the plains. Other positives include the continued rise in Russian exports, and the start of the 30 MlnT Australian crop, which is just coming to the market as physical wheat. China have continued to be absent from the market, pushing US exports 40% lower than the previous four weeks.

Looking at Europe and the UK, the lack of buying ahead of the Brexit news has pushed prices lower, however, with news this week that the UK will need to import 1 MlnT of wheat for the second half of this season to avoid going into deficit, means that prices are likely to remain supported at higher levels than we would like to see for some time to come.Whilst we may consider that our domestic UK prices are high, they are still lower than imports, so the downside does feel limited.

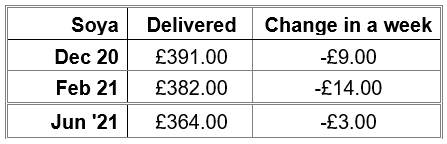

Soya

Soya prices have seen a mixed week. The market moved $8 lower with improved prospect of rain across South America, but has since turned and moved back up over fears that rain may not provide sufficient moisture. Argentina have planted 43% of their crop, which is in line with their 5 year average. USDA figures this week also confirmed that meal sales are around 39%, again in line with the 5 year average, but it is important to remember, this was a large crop, despite being downgraded, therefore in tonnage terms, volume would be up. China continue to be absent from the market and have been now since 6th November.

The tight situation with Sunflower seed in Russia looks to be finally resolving itself, with the large market shorts which had been created by the late harvest and farmer stockpiling now being worked out. Russia is implementing a ban on the export of sunflower seed, domestic crushers are now seeing the benefit and finally able to make offers to the market.

And Finally…

Santa is officially given ‘key worker’ status

With Christmas now only two and a half weeks away, many children have been concerned that Santa may have to cancel his plans this year due to Coronavirus restrictions but on his official facebook page this week, Santa confirmed that this was not the case.

Santa’s Facebook page confirmed that he has been practicing social distancing and isolating with his elves in preparation for the big day. He has also now been given official `essential worker’ or `key ‘worker status (depending on which side of the Atlantic you are), giving him the authority to carry out his duties as planned this year.

Nicola Sturgeon confirmed this in a speech, saying, ‘Santa will not be prevented from delivering presents this year. Santa is a key worker and has lots of magical powers to make him safe to do that. Santa will be delivering presents as normal’.

So remember to look at the skies on Christmas Eve and see if you can spot him making his way to your house!

Regards,

Kay Johnson & Martin Humphrey