Currencies

Currency is still range bound, with very little fresh news from the market. The UK is still awaiting a decision on how long or what tier system will be put in place post lockdown on 2nd December. Whilst it has been reported that Brexit negotiations are progressing in Brussels, we have yet to hear any concrete details.

Looking at the US, it is becoming clearer that as the recounted votes come in, Biden has won the election, although there remain concerns as to what Trump will attempt to do between now and January with the view, he will not go quietly! One newspaper reported this week he will use this time to ‘pardon his cronies’.

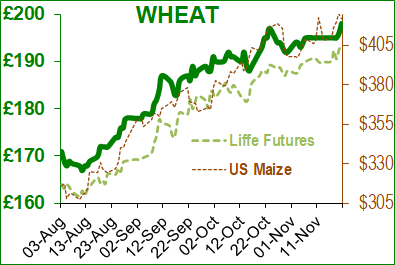

Wheat

Global markets have continued on their slow move lower this week. US exports were down 50% week on the week and 46% down on the previous four weeks.

The Australian harvest is progressing well with estimates that they will have a crop of around 30 MlnT, which could give them an exportable surplus of between 10 and 15 MlnT, providing competition to the Black Sea and Matiff markets. Looking closer to home, the November contracts have rallied this week, more on position squaring ahead of those contracts expiring.

France are reportedly now 88% planted and Russia continues to push their exports, all putting pressure on prices.

Strategie Grain this week have released some early figures on plantings, suggesting that 1,974,000 hectares have been planted against 1,761,000 in a normal year. If this is correct and yields are good then this could potentially produce a crop of around 16 MlnT. Wheat imports for year to date are up at 700,000t against a normal year which is around 300,000.

Soya

Soya prices have continued their rally with ongoing concerns over pressure on US beans for February/March time to compensate for the late planting in Brazil. There is now some rain forecast across South America which has encouraged the planting pace in Argentina (which is always later than Brazil), to gather speed.

Soya beans are following the oil market which is taking its lead from palm prices. Malaysia has reported there will be issues with their Q4 production because of weather and also border issues. The pandemic is making it difficult to get workers from across the borders. Further ahead though, the US are expected to plant a record 89 million acres of beans for next year against the previous record of 83 million for 2020.

And Finally…

The burning question of the week… is it too early to get the Christmas tree up?

Never mind electric cars, gas boilers, the vaccine, Brexit and the economic forecast. The burning question of the week is this; is it too early to put up your Christmas decorations?

Trees and decorations traditionally start going on display when Advent begins on the fourth Sunday before Christmas which this year would be 29th November but for many this year, they can hold off no longer

It may buck tradition, but surely the sooner we get our halls decked with spirit-raising holly and ivy, the better it will be for everyone?

Alternatively you may still have rather a lot of ‘humbugs’ left in your tin, in which case please find solace in the simple logic shown in the picture below!

Regards,

Kay Johnson & Martin Humphrey