Currencies

Sterling has been pretty range bound this week against both the $ and €. At the time of writing, we still do not yet know the outcome of the trip which Boris Johnson has made to Brussels to try to save the Brexit deal being discussed, and the deadline has been extended again until…….well, we do not know when the new deadline is extended until! The $ continues to see pressure this week with Covid cases continuing to rise exponentially across the US and details of the new Coronavirus Aid Bill still not apparent.

Wheat

The wheat market has seen yet another choppy week. The US markets started the week on a downward trend with funds switching their positions from net long, to net short, for the first time in months. This was on the back of Australia revising their crop up to 31.2 MlnT and Canada revising theirs up to 35.18 MlnT.

India confirmed that they would also be releasing more wheat onto the marke, which helped lower prices further. Since Thursday however, market sentiment has changed. The USDA report put global end stocks down to 316.5 MlnT, from 320.45 MlnT last month, which wrongfooted the market and pushed US prices back up.

Looking at Europe, news that China will look to buy an additional 1.5-2 MlnT of wheat from France because of the ongoing issues with Australia will only put more pressure on the Northern Hemisphere stock. China are not prepared to buy from Australia as they normally would, until they receive an apology from the Australian Prime Minster who has been very vocal about placing the blame for the pandemic with China.

President Putin announced this week his intention to lower domestic wheat prices by enforcing a quota for between Feb and June 2021 which further supported prices. The UK has seen little news in its own right and while it started the week drifting lower but has turned sharply back up following the Matif’s lead.

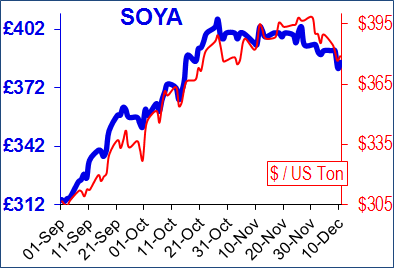

Soya

The soya market continues to be very much a weather market with prices moving lower at the start of the week on improved rain forecasts across South America. China has been cancelling shipments of US beans this week on the back of lower crush margins and high inventories. The USDA report did not give any real surprises for Soya. The US carryout was put at 175 Mln Bushels, down from 190 Mln Bushels which would be a seven year low. Brazil estimate their crop will be 131.79 MlnT, which would be an all time record but with soil conditions at their worst for 10 years, the market expects this to be downgraded.

And Finally…

Seek & find puzzle- can you find the grumpy carol singer at the Christmas market?

Can you find the seven naughty elves hiding in the virtual Christmas party?

Regards,

Kay Johnson & Martin Humphrey