The UK May futures contract has essentially expired (46 lots), so attention moves to the November wheat futures where a rapid price rise occurred from last Fridays close at about £148, touching previous contract highs (July 17) today at £154.25; and finally closing this week at £153.75.

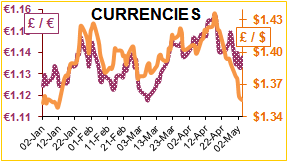

The July futures are not worth anything to man nor beast, and do not reflect physical values. Drivers include Sterling falling on news that the probability of an interest rate increase is almost nil; 14 trading days ago £1 was worth $1.43, and is now only $1.35. DEFRA released data this week showing that in 2017, English wheat growers were paid an amount commensurate with a planted wheat area of about 45,000ha smaller than DEFRA’s official crop figure. This suggests 360,000T less UK wheat in 2017, tightening balance sheets further for 2017-18, resulting in a reduced carry-in for the 2018-19 season; so finally the trade are vindicated (and DEFRA’s old figures were [officially] rubbish). The UK grain supply is still suffering from imbalanced distribution (north to south) but the dynamics might change as the bioethanol plants are importing maize and wheat, and reducing their dependence on southern wheat. European markets also continue to move higher following the US market.

Chicago July wheat futures touched 16-month highs this week. The funds are short (have sold) covering because the Wheat Quality Council tour estimate the Kansas winter wheat yield at 1Mln T/acre down on both last year (1.3Mln T/acre) and the five-year average (1.1Mln T/acre). This indicates a large drop in the total crop. Next week we await the USDA’s first estimates of this season's US and world wheat crops and prior to this announcement there may be volatility associated with fund positioning. US export sales came in at almost 4.5Mln T below last year at this stage. Adding to the fears, there are reports that the weather in the Ukraine continues to be hot and dry and could damage crops, reducing expectations for early spring grains despite a senior weather forecaster’s assurances that there is unlikely to be any damage so far. Who do you believe? Place your bets!

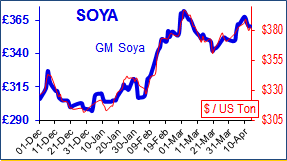

Soya prices remain volatile with ambiguous information containing simultaneous arguments for both market rises and falls. The April USDA report helped rally prices with US soya acreage almost 2Mln acres lower than previously expected, so there is more soya planted than maize in the US for the first time in 30 years. The same ambiguity was seen in the US-China trade discussions, with some reporting positive news on a trade deal while others reported disagreement and no sign of China backing down and no new US soya deals to China since the tariff issue began. Chinese officials are also reported to be discussing domestic incentives to increase soya planting to reduce the reliance on imports. With old crop soya sales up by about 2Mln T things could get ‘interesting’. So will we be above or below the waterline? GM soya is currently about £375 ex-UK port.

Ships were subject to weight legislation by the Cretans in 2500BC, and since then by the Romans, Venetians, Genoans etc. But legislation did not prevent disasters caused by overloading; thus the sinking of the SS London in 1866 with the loss of 220 souls (out of a total crew of 239), loaded with 345 tons of railway tracks for Australia, was the last straw for UK authorities. In 1860, Samuel Plimsoll MP took up the challenge and after 16 years the Plimsoll mark, indicating the maximum waterline for all ships, was made compulsory. As the buoyancy of a ship varies with temperature and salinity, the letters TF stand for tropical fresh water, F fresh water, T tropical seawater, S summer temperate seawater, W winter temperate seawater and WNA winter North Atlantic. LR stands for Lloyds Register. In the 1870s, canvas upper and rubber soled shoes were called ‘Plimsolls’ because if water exceeded the line of the rubber sole, the wearer would have wet feet.